When to Redesign Your Mortgage Loan Officer Website: Key Signs and Benefits for Lead Generation

In the competitive landscape of mortgage lending, having an effective website is crucial for attracting and converting leads. A well-designed website not only serves as a digital storefront but also plays a significant role in establishing credibility and trust with potential clients. This article will explore the key signs that indicate when it’s time to redesign your mortgage loan officer website and the benefits that come with such a transformation. By understanding these factors, you can enhance your online presence and improve lead generation efforts. We will cover critical signs for a redesign, the main benefits of updating your site, essential features for modern mortgage websites, and how LoanSites can assist in this process.

What Are the Critical Signs Your Mortgage Website Needs a Redesign?

Recognizing when your mortgage website requires a redesign is essential for maintaining a competitive edge. Several indicators can signal the need for an update, including outdated design, poor user experience, and low conversion rates.

How Does Outdated Design and Poor User Experience Affect Your Website?

An outdated design can significantly impact user retention and engagement. Websites that appear old or unprofessional may lead to higher bounce rates, as visitors are less likely to trust a site that looks neglected. Additionally, poor user experience, such as slow loading times or complicated navigation, can frustrate users, causing them to leave before converting into leads. Research shows that a well-structured and visually appealing website can enhance user satisfaction and retention.

Why Is Mobile Responsiveness Essential for Mortgage Websites?

With the increasing use of mobile devices for browsing, having a mobile-responsive website is no longer optional. Statistics indicate that over 60% of web traffic comes from mobile devices, and users expect seamless experiences across all platforms. A mobile-friendly design not only improves user experience but also positively impacts SEO rankings, making it essential for mortgage websites aiming to attract a broader audience.

What Are the Main Benefits of Redesigning Your Mortgage Loan Officer Website?

- Improved User Experience: A modern website design focuses on user-friendly navigation and accessibility, making it easier for potential clients to find the information they need.

- Increased Lead Generation: By optimizing your website for conversions, you can significantly boost lead generation. A well-structured site with clear calls to action encourages visitors to engage with your services.

- Enhanced SEO Performance: A redesign often includes SEO best practices, which can improve your website’s visibility in search engine results, driving more organic traffic to your site.

For mortgage professionals looking to maximize these benefits, partnering with a specialized service can streamline the redesign process.

Which Modern Features Should a Mortgage Website Include in 2026?

As technology evolves, so do the features that mortgage websites should incorporate to remain competitive. Essential features for modern mortgage websites include mobile-first design, interactive tools, and secure application processes.

Why Is Mobile-First Design Crucial for Loan Officer Websites?

Mobile-first design prioritizes the mobile user experience, ensuring that websites are optimized for smaller screens. This approach is crucial as it aligns with user behavior trends, where mobile browsing continues to rise. A mobile-first strategy not only enhances user experience but also improves SEO rankings, as search engines favor mobile-optimized sites.

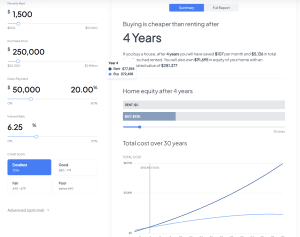

How Do Interactive Tools Improve User Engagement and Compliance?

Interactive tools, such as mortgage calculators and application forms, can significantly enhance user engagement. These features allow potential clients to interact with your website actively, providing them with valuable information tailored to their needs. Additionally, incorporating compliance features ensures that your website meets industry regulations, fostering trust and credibility with users.

Interactive tools, such as mortgage calculators and application forms, can significantly enhance user engagement. These features allow potential clients to interact with your website actively, providing them with valuable information tailored to their needs. Additionally, incorporating compliance features ensures that your website meets industry regulations, fostering trust and credibility with users.

How Does LoanSites Approach Mortgage Website Redesigns for Success?

LoanSites specializes in creating and managing mortgage websites that are designed to convert visitors into leads. Their approach to website redesign focuses on quick deployment, unlimited support, and advanced SEO integration.

What Is the 10-Day Website Build Promise and Its Advantages?

LoanSites offers a unique 10-day website build promise, ensuring that your new site is up and running quickly. This rapid deployment allows mortgage professionals to establish or enhance their online presence without prolonged downtime. The advantage of this approach is that it minimizes disruption to your business while maximizing your ability to attract new clients.

How Does Advanced SEO Support Post-Redesign Growth?

Post-redesign, LoanSites integrates advanced SEO strategies to support ongoing growth. By optimizing your website for search engines, they help ensure that your site remains visible to potential clients. This focus on SEO not only drives traffic but also enhances the overall effectiveness of your lead generation efforts.

Indeed, the core principles of SEO are designed to elevate a website’s presence and attract a steady stream of potential customers.

SEO for Financial Websites: Boosting Traffic & Potential Customers

Search engine optimization (SEO) is a relatively new type of marketing that focuses on optimizing web pages to gain higher rankings in search results. The main benefit of optimizing your website is an increase in website traffic. An example would be typing “need fast money now” or “buying a house loan” into any search engine and viewing the results. If your page is at the top of the search engine results, the search engine thinks your web page has the most relevant answer to these queries, opening the gate to potential customers.Optimization of website strategies: A review of guidelines for financial organizations´ search engine optimization

Different aspects of a website redesign can significantly impact its effectiveness in generating leads.

This table illustrates how each feature contributes to the overall effectiveness of a mortgage website, emphasizing the importance of a comprehensive redesign strategy.

In conclusion, recognizing the signs that your mortgage website needs a redesign is crucial for maintaining a competitive edge in the industry. By understanding the benefits of a modern website and incorporating essential features, mortgage professionals can significantly enhance their online presence and lead generation efforts. Partnering with experts like LoanSites can streamline this process, ensuring a successful transition to a more effective digital platform.

Conclusion

Recognizing the need for a website redesign is essential for mortgage professionals aiming to stay competitive and enhance lead generation. By embracing modern design principles and essential features, you can significantly improve user experience and SEO performance. Collaborating with experts like LoanSites ensures a seamless transition to a more effective online presence. Take the next step in elevating your mortgage business by exploring our tailored website solutions today.