Must-Have Features for a High-Converting Mortgage Website: Essential Tools and Strategies for Loan Officers

In the competitive landscape of mortgage lending, having a high-converting website is essential for loan officers. This article explores the must-have features that can significantly enhance conversion rates, focusing on mobile optimization, lead generation tools, interactive elements, and trust signals. Readers will learn how these features not only improve user experience but also drive more leads and conversions. Many loan officers struggle with outdated websites that fail to engage potential borrowers effectively. By implementing the right strategies, you can transform your online presence into a powerful lead-generating machine. We will delve into mobile optimization, effective lead generation tools, engaging interactive elements, and the importance of trust signals in building credibility.

How Does Mobile Optimization Enhance Mortgage Website Conversions?

Mobile optimization is crucial for mortgage websites, as a significant portion of users now access these sites via mobile devices. A mobile-optimized site ensures that users have a seamless experience, which can lead to higher engagement and conversion rates. Research indicates that mobile-friendly websites can increase user retention and reduce bounce rates, ultimately enhancing overall site performance. By prioritizing mobile optimization, loan officers can cater to the growing number of borrowers who prefer to conduct their mortgage searches on smartphones and tablets.

Why Is Mobile-Responsive Design Critical for Mortgage Websites?

Mobile-responsive design is essential for mortgage websites because it allows the site to adapt to various screen sizes and orientations. This adaptability enhances user experience by ensuring that content is easily readable and navigable, regardless of the device used. A well-designed mobile site can significantly improve user engagement, leading to higher conversion rates. Additionally, search engines like Google prioritize mobile-friendly sites in their rankings, making responsive design a critical factor for SEO.

The importance of SEO for visibility and attracting potential customers is a well-established principle in digital marketing.

SEO Guidelines for Mortgage Websites

Search engine optimization (SEO) is a relatively new type of marketing that focuses on optimizing web pages to gain higher rankings in search results. The main benefit of optimizing your website is an increase in website traffic. An example would be typing “need fast money now” or “buying a house loan” into any search engine and viewing the results. If your page is at the top of the search engine results, the search engine thinks your web page has the most relevant answer to these queries, opening the gate to potential customers.

Optimization of website strategies: A review of guidelines for financial organizations´ search engine optimization

What Are Best Practices for Fast Load Speeds and Intuitive Navigation?

Fast load speeds and intuitive navigation are vital for retaining visitors on mortgage websites. Users expect pages to load quickly; delays can lead to frustration and increased bounce rates. Best practices for improving load speed include optimizing images, minimizing HTTP requests, and leveraging browser caching. Intuitive navigation, on the other hand, involves creating a clear and logical structure that allows users to find information easily. Implementing these practices can significantly enhance user satisfaction and encourage potential borrowers to explore your offerings further.

Which Lead Generation Tools Drive High Conversion Rates on Mortgage Websites?

Effective lead generation tools are essential for converting website visitors into potential borrowers. These tools help capture user information and facilitate communication, ultimately driving higher conversion rates. Key lead generation tools include optimized lead capture forms, high-converting landing pages, and engaging lead magnets. By integrating these tools into your mortgage website, you can create a streamlined process for collecting leads and nurturing them through the sales funnel.

This emphasis on optimizing websites for lead generation and revenue is further supported by recent research.

Website CRO for Lead Generation & Revenue

Currently, their primary source of new clients is through their website because after trying other channels, website is the most effective and digital marketing nowadays have proven to be highly impactful. To increase sales and help PT. LVC grow, their website needs to be optimized to generate leads or potential customers, ultimately boosting revenue. Increasing revenue is PT. LVC current primary objective. To achieve this, the conversion rate optimization theory developed by Chris Goward (2012) will be utilized, with a qualitative approach.

Enhancing PT. LVC Website Marketing Strategy To Generate Leads Through Conversion Rate Optimization (CRO), AR Qastharin, 2024

- Optimized Lead Capture Forms: These forms are designed to collect essential borrower information while minimizing friction. Key elements include clear calls to action, concise fields, and mobile-friendly designs. By optimizing these forms, loan officers can maximize the amount of information collected from potential borrowers, leading to more qualified leads.

- High-Converting Landing Pages: Landing pages are crucial for directing traffic to specific offers or services. A well-designed landing page should focus on a single call to action, provide compelling content, and include trust signals such as testimonials or certifications. This focused approach can significantly increase conversion rates.

- Lead Magnets: Offering valuable resources, such as eBooks or mortgage calculators, can entice visitors to provide their contact information. Lead magnets serve as incentives for users to engage with your site and can be instrumental in building a robust email list for future marketing efforts.

For loan officers looking to enhance their lead generation efforts, utilizing tools like those offered by LoanSites can streamline the process. Their services include advanced SEO and website development tailored specifically for mortgage professionals, helping ensure that your site is optimized for maximum lead capture.

What Interactive Mortgage Site Elements Engage Users and Educate Borrowers?

Interactive elements on mortgage websites can significantly enhance user engagement and provide valuable educational resources for borrowers. These features not only make the site more appealing but also help users understand complex mortgage concepts. By incorporating interactive tools, loan officers can create a more dynamic and informative experience for potential clients.

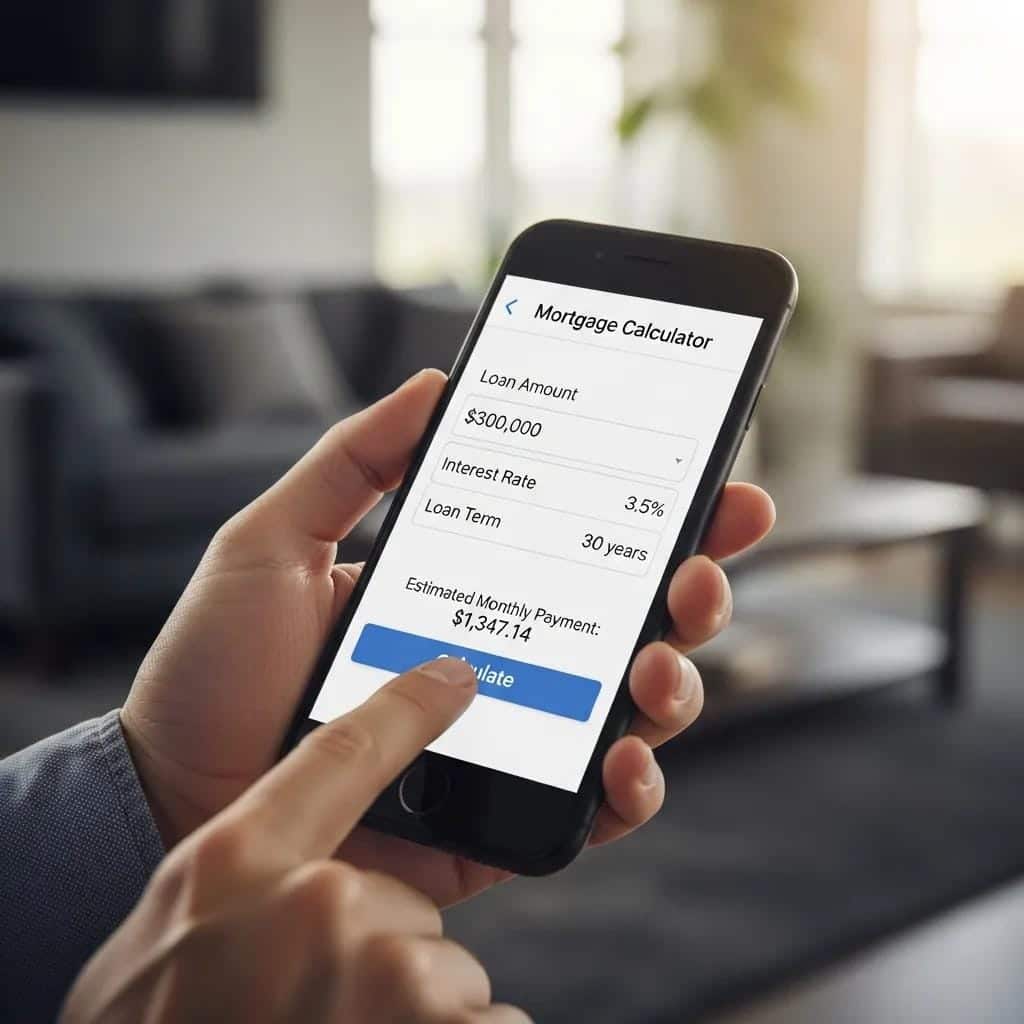

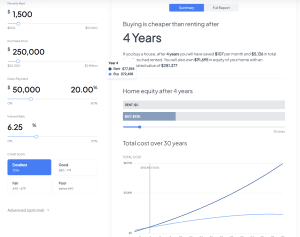

How Do Mortgage Calculators and Real-Time Rate Comparison Tools Work?

Mortgage calculators allow users to input their financial information and receive instant estimates on monthly payments, interest rates, and loan terms. These tools empower borrowers to make informed decisions by providing personalized insights into their mortgage options. Real-time rate comparison tools further enhance this experience by allowing users to compare current mortgage rates from various lenders, helping ensure they find competitive deals.

Why Are Pre-Qualification Forms Important for Early Lead Qualification?

Pre-qualification forms are essential for early lead qualification as they help loan officers assess a borrower’s financial situation before proceeding with the mortgage process. By collecting basic information about income, credit score, and desired loan amount, these forms enable loan officers to identify potential borrowers who are more likely to qualify for a mortgage. This early qualification process can save time and resources for both the borrower and the loan officer.

How Can Trust Signals and Loan Officer Profiles Build Credibility on Mortgage Websites?

Building trust is crucial for converting website visitors into borrowers. Trust signals, such as client testimonials, reviews, and professional certifications, play a significant role in establishing credibility. By showcasing these elements on your mortgage website, you can reassure potential clients of your expertise and reliability.

What Impact Do Client Testimonials and Reviews Have on Conversion?

Client testimonials and reviews provide social proof that can significantly influence a potential borrower’s decision-making process. Positive feedback from previous clients can enhance your reputation and encourage new visitors to trust your services. Displaying testimonials prominently on your website can lead to increased conversion rates, as potential borrowers feel more confident in choosing your services.

How Do NMLS Badges and Security Certifications Enhance User Trust?

NMLS badges and security certifications are essential trust signals that demonstrate compliance with industry standards and regulations. Displaying these badges on your mortgage website can reassure visitors that you adhere to best practices and prioritize their security. This transparency can enhance user trust and ultimately lead to higher conversion rates, as borrowers feel more secure in sharing their personal information.

Conclusion

Implementing essential features on your mortgage website can significantly boost conversion rates by enhancing user experience and trust. By focusing on mobile optimization, effective lead generation tools, and interactive elements, loan officers can attract and retain potential borrowers more effectively. The value of a well-optimized site cannot be overstated, as it directly impacts your ability to generate leads and close deals. Start transforming your online presence today by exploring our comprehensive resources tailored for mortgage professionals.